Break-even point BEP: What it is and how to calculate it

The contribution margin is determined by subtracting the variable costs from the price of a product. Simply enter your fixed and variable costs, the selling price per unit and the number of units expected to be sold. In corporate accounting, the breakeven point (BEP) is the moment a company’s operations stop being unprofitable and starts to earn a profit.

Break-Even Calculator

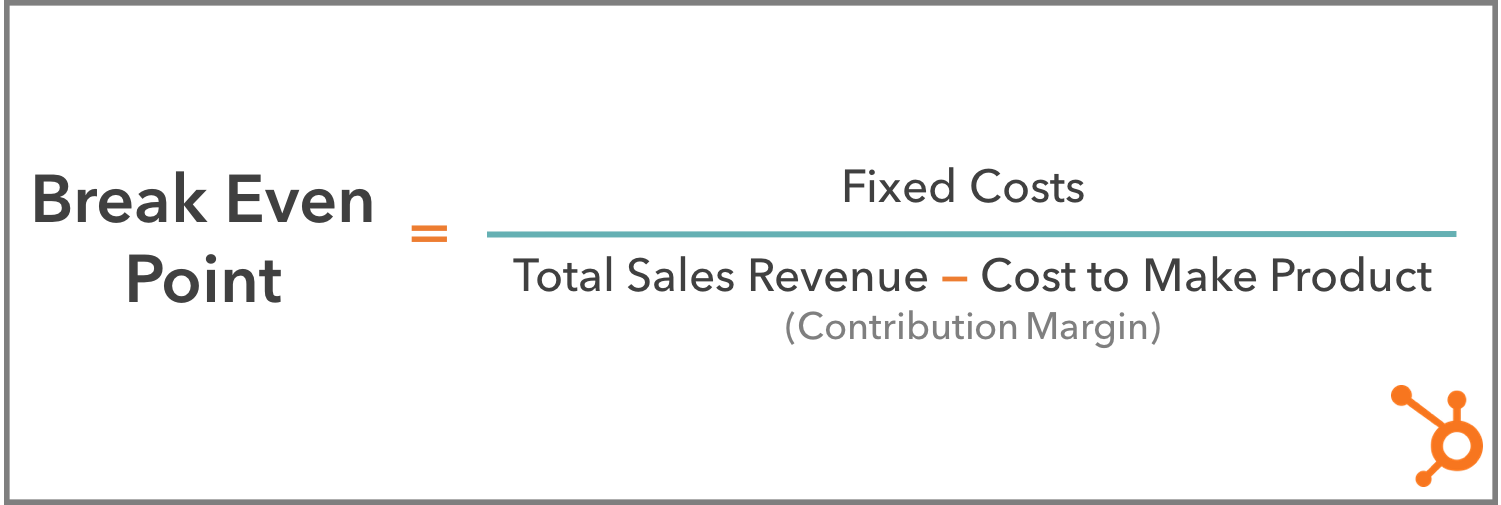

To determine the break-even point, you can calculate a break-even analysis in two different ways, involving either the number of units sold or the total revenue in dollars. A break-even analysis relies on three crucial aspects of a business operation – selling bookkeeping and accounting articles price of a unit, fixed costs and variable costs. On the other hand, variable costs are largely dependent on the volume of work at hand – if you have more clients, you will need more labor and materials which results in an increase in variable expenses.

What Is the Breakeven Point (BEP)?

The breakeven point doesn’t typically factor in commission costs, although these fees could be included if desired. Break-even analysis looks at fixed costs relative to the profit earned by each additional unit produced and sold. By knowing at what level sales are sufficient to cover fixed expenses is critical, but companies want to be able to make a profit and can use this break-even analysis to help them. If you won’t be able to reach the break-even point based on your current price, you may want to increase it.

Focus on a single product or service

To make the topic of Break-even Point even easier to understand, we created a collection of premium materials called AccountingCoach PRO. Our PRO users get lifetime access to our break-even point cheat sheet, flashcards, quick test, business forms, and more. To get a better sense of what this all means, let’s take a more detailed look at the formula components. Central to the break-even analysis is the concept of the break-even point (BEP). The following break-even point analysis formulas will help you get there.

- Calculate the break-even point in units sold, or \(n\) at break-even.

- For any new business, this is an important calculation in your business plan.

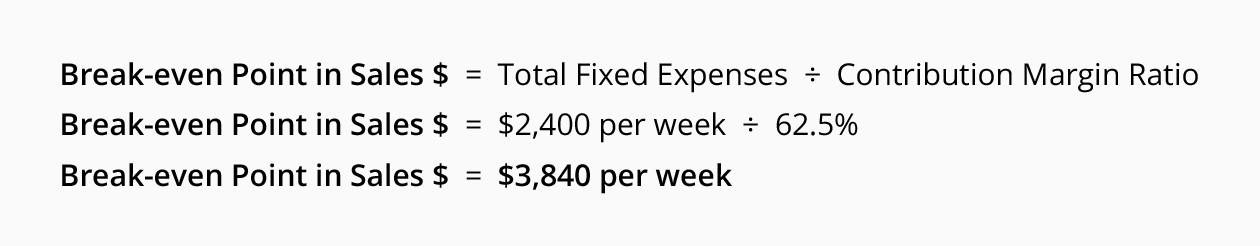

- Recall that we were able to determine a contribution margin expressed in dollars by finding the contribution margin ratio.

- In addition, changes to the relevant range may change, meaning fixed costs can even change.

- Generally, expenses are debited to a specific expense account and the normal balance of an expense account is a debit balance.

The break-even point is the volume of activity at which a company’s total revenue equals the sum of all variable and fixed costs. The break-even point is the point at which there is no profit or loss. Assume a company has $1 million in fixed costs and a gross margin of 37%. In this breakeven point example, the company must generate $2.7 million in revenue to cover its fixed and variable costs.

Shape Calculators

Easily calculate the break even point for any product or service and generate a graph with the break-even point. Estimate how many units you need to sell before you break even, covering both your fixed and variable costs, and how long it would take you. However, using the contribution margin per unit is not the only way to determine a break-even point. Recall that we were able to determine a contribution margin expressed in dollars by finding the contribution margin ratio.

Break-even price calculations can look different depending on the specific industry or scenario. As you can see, for the owner to have a profit of $1,200 per week or $62,400 per year, the company’s annual sales must triple. Presently the annual sales are $100,000 but the sales need to be $299,520 per year in order for the annual profit to be $62,400. As the result of its pricing, if Oil Change Co. services 10 cars its revenues (or sales) are $240. For the reasons shown in the above list, Oil Change Co.’s variable expenses will be $9 if it services one car, $18 if it services two cars, $90 if it services 10 cars, $900 if it services 100 cars, etc.

It helps you figure out how many units you need to sell or services you need to provide to make sure your investment pays off. For instance, if your restaurant is introducing a new signature dish, you’ll want to know how many orders of that dish you need to sell to cover the costs of ingredients, staff time, and marketing. Break-even analysis looks at internal costs and revenues, but doesn’t factor in external influences that can impact your business. — e.g., changes in market demand, economic conditions, inflation, supply chain disruptions, etc. For instance, if shipping costs rise due to global supply chain problems, your variable costs might go up and can throw off your original calculation.